Future of Small Business Financing in a Post-Pandemic World

COVID-19 has severely affected small business financing. Traditionally, when a small business seeks financing from a Bank, the Bank would perform a qualitative and quantitative analysis to determine if the loan request meets the Banks’ risk appetite. To determine risk appetite, Banks will perform an adjudication of credit, which includes a review of the purpose of funds, borrower creditworthiness, industry analysis, credit analysis of financial statements, and assign a risk rating. Ultimately, the risk rating is weighted on three factors known as the expected default rate, the loss given default, and the expected loss. If the loan request is within a Bank’s appetite for that risk, the application would be approved. As a result of COVID-19, Banks are now putting significantly greater emphasis on three aspects of their credit adjudication process: industry analysis, credit analysis of financial statements, and risk rating.

Let’s begin with industry analysis. For all companies, it has been almost impossible to avoid some form of disruption of operations due to the impacts of COVID-19. Many small businesses have been forced to temporarily shutdown operations as a result of the nature of the services they provide to customers. Companies most affected are retail and hospitality services, travel industries and companies with foreign manufacturing. If a company is in a service business or has seen its supply chain impacted, Banks will be more reluctant to extend financing. The long-term impact on small businesses is more difficult to determine, but it is highly likely that Banks will continue to avoid financing companies with ‘pandemic’ risk in the future. As long as COVID-19 remains a threat, Banks will factor this into their decisions.

Another factor the Banks will focus on is credit worthiness. This is the bulk of the credit adjudication process. Banks will look at the financial performance of the company over the last two years to determine if the companies expected cash flow is sufficient to cover monthly payments and allow the business to generate a profit while ultimately repaying the loan. However, with the impact of COVID-19, Banks will discount the company’s financial performance over the last two years. I wouldn’t be surprised if Banks discount past financial performance by over 50% for many industries. For example, a hotel that averaged over 80% customer occupancy rate over the last two years is highly unlikely to maintain these levels over the next 18–24 months. Or a travel business that relies on vacationers could see their business vanish over the next 12 months. In both scenarios, past performance is not an accurate reflection of future performance. The point being, Banks will now be more stringent when analyzing financing statements and will apply a significant discount to previous financial performance moving forward. Banks will focus on lending against business assets but will also apply significant discounts to these values given the market conditions.

So, what does this mean for businesses looking for bank financing? All Banks are now operating in a risk adverse environment. Banks are now focused on only financing new deals that have very low risk and will avoid new deals with even low to moderate risk. Simply put, getting business financing from traditional Banks has became more difficult for all small businesses.

Businesses will have to continue to look elsewhere for funding options and FinTech will be a viable solution. The Canadian Lenders Association agree. They have issued an open letter to the Canadian Government advocating for the use fintech lending to provide proposed stimulus. Our ability to deploy capital in a timely and fiscal manner would be a valuable resource.

The Government of Canada has engaged BlueDot Inc. (leveraging Artifical Intelligence to track infectious diseases) to track and monitor national cases of COVID-19. It would be prudent to leverage the leaders in alternative funding to provide stimulus to the SMB market in Canada and the USA.

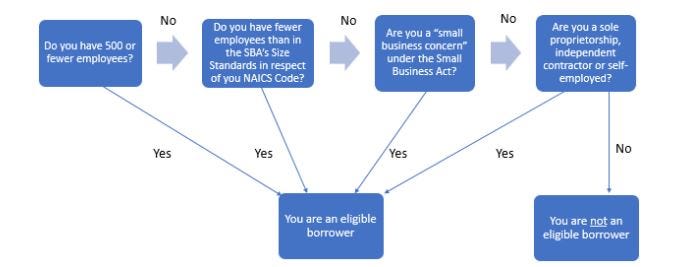

The US government has announced an extensive stimulus package to provide assistance to SMB’s in this time. This will run through the SBA and other government programs for the time being. It is still to be determined if they will leverage any 3rd party financial technology companies to deploy.

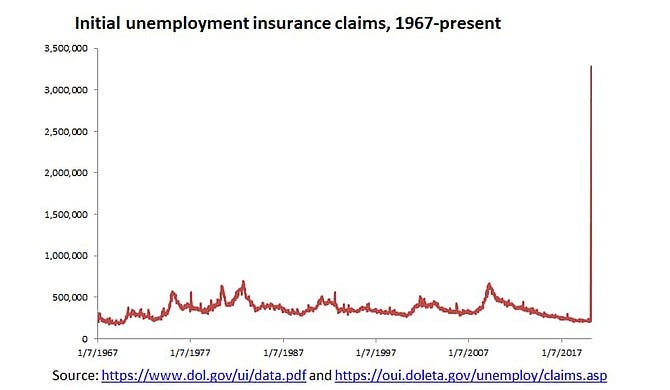

Most of these programs are starting in April of this year, but some fear that may be too late for most businesses. Certainly the number of unemployment claims would be a reflection that we are too late for the first group of small businesses.

We shall see how well government agencies deploy the stimulus. The speed of deployment is as important as the underwriting in these times. Certainly there should be some consideration to partnering with companies that have the ability to deploy capital quickly and efficiently in these

If you are a startup or small business looking at capital options, we provide assistance to startup and small businesses through alternative financing options.

Corl Revenue Sharing provides financing to high-growth startups without giving up equity.