Why BigTech is good for FinTech

Google, Apple, Facebook and Amazon have all developed or are launching financial products aimed at taking market share from our larger Financial Institutions. Why this invasion should be terrifying to Financial Institutions and why it is great for FinTech.

Corl is an artificially-intelligent platform that finances businesses in the digital economy and shares in their future revenue. If you’re interested in learning more about revenue sharing, welcome to connect with Corl directly through Twitter, LinkedIn or through our website.

The announcements have been covered in detail, summaries to some of their financial products and links to more reading below:

- Google checking account and expansion into consumer banking via Google Pay

- 13% allocation to Fintech for Google Ventures

Apple

- Organization of Libra

- Facebook Pay

- A number of patent announcements in the lending, e-commerce spaces

Amazon

There is a lot of concern around privacy and data, as well as monopolistic influences, as there should be. I don’t want to highlight these issues in this article, but government is starting to realize the hazards of BigTech exploiting personal data. Facebook’s recent inquiries have suggested that our governing bodies are going to regulate these industries a little stricter. In addition, these companies will be under a finer lens when it comes to expanding into financial services.

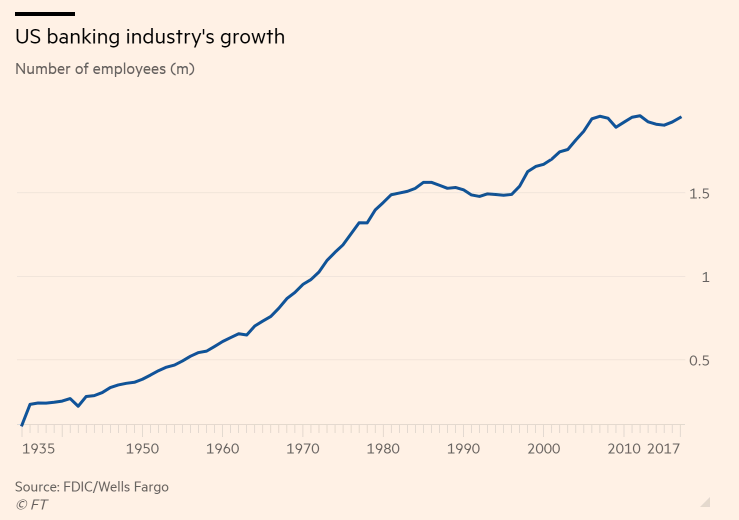

Before I expand into why this is great for Fintech, I would like to consider the growth of financial technology over the past 10+ years. The majority of financial technology advancement came about after the 2008 economic crisis. Society realized the costs to human error and technologists started developing solutions to improve processes. The incumbents of the industry remained and their inability or decision not to keep pace with financial innovation is resulting in a loss of market share.

Big banks have never been friendly to FinTech startups. There’s a rule of thumb in entrepreneurial circles, in that if you’re relying on big banks as your first customers, your business won’t last very long. Typically banks would like to see a history of operations and sustainability before beginning real conversations around integrating, partnerships, joint ventures. Once conversations begin, depending on the level of involvement, it usually takes 2–3 years to finalize, not including implementation. This timing is impossible for most FinTech startups, not to mention the rate at which technology is advancing, something created 3–5 years ago has likely been adapted and improved.

Progress moves very quickly and the fault lies in the structure and culture of the larger institutions. They’re large ships that take time to maneuver. They have regulation and compliance to abide by at every turn and they have approval processes that require sign off by more people than the startup pitching them would have employees. It costs them a lot of time and resources to invest in new working relationships and it’s too great a risk to work with a younger company that has the potential of failing. When compared to BigTech, their leadership is firmly financial focused, with very little experience in technology.

BigTech incumbents are quite the opposite. And this should terrify banks. BigTech is very receptive to innovation and change, with leadership deeply technology focused. This kind of leadership is open to collaboration with earlier-stage businesses, through partnership or even in a customer role. They understand technology and will recognize opportunities faster.

Fintech startups now have potential customers/partners with millions of users, market capitalization and transaction numbers; scale that was otherwise not available. Corl expects the next decade to be one of tremendous innovation in the Fintech space for this reason.

What can banks do to protect market share? Is there any hope of keeping their market share now that BigTech is moving into the financial markets?

The short answer is no. We will see BigTech take a considerable portion of the market moving forward. The banks that will retain their positions in the market are the ones listening to customers and investing in technology innovation.

More good news for the FinTech industry. In addition to BigTech providing larger customers and partnership opportunities, we will see banks embrace acquisitions and partnerships with earlier stage financial technology businesses. With the increase in venture and investment into FinTech, it has never been a better time to start a financial technology company.